|

|

|

|

|

I receive Child Support of $800 per month and SSI of 1238 per month for children. After a bankruptcy, a prospective borrower must be diligent about establishing new credit and making all payments on time. The Ask Experian team cannot respond fha 560 credit score mortgage to each question individually. I was very satisfied with the representation and would use your services again if the need arises, and also recommend you highly to my friends. El Nissan Tiida 2010 tiene un valor de $10,710, incluyendo el env o. Letters of intent often include provisions pertaining to negotiations and/or confidentiality. Sep the fha streamline refinance mortgage insurance premium mip refund chart. The 580 credit score mortgage is finally back for borrowers that have compensating factors. You will find the namesake RV, the Forest River Berkshire diesel and also the flagship model of Forest River RV, the Forest River Charleston. Our client was extremely happy they were able to get a lower mortgage payment even though [.] Read more. Most traditional lenders use the credit score system as the centerpiece for underwriting guidelines. Transunion has the most update information. This provides easy and powerful loan officer tools. For fast acceptance along with quick, successful services for payday loans online, look no further than tiloans.com. Learn about the 8 benefits you can take advantage of when you consolidate debt. Business LoansDevon IT, Inc., (www.devonit.com) is a leading information technology company that offers thin client software, hardware, and virtual desktop solutions. FHA manual underwriting is what makes it possible to close home loans for people with bad credit scores. Many of them can't see beyond the cost of what it will take to the path to home ownership. It would be unfair if we won’t visit WAI YING again in Binondo to try their other yummies. I wonder where can I get a good instant cash loan. Once your are approved for a loan, the lender will ask that you provide your banking information so that the lender can instantly wire transfer the loan amount into your personal bank account. About Evergreen InsuranceI also have a down payment of up to 5% on a $170,000 loan. With 475 in debts that allows a payment with taxes, insurance, HOA fees of up to $525 for you. With the holiday weekend, the rescore and normal scoring update is taking a lag so I am not sure where I am now, but with these numbers (and potential for more growth with the accounts paid up), 2 years of rental history/ deployment records (army), 1 year of on time car payments, 2 years of on time credit payments to my debt consolidation program, and a formal explaination explaining the late periods from deployment, would I qualify. I have a car note of $446 a month and a credit card bill of $25 a month. House for Rent close to Mall - $700 / 3br - 1800ft² - (Lowell N.C.) pic. Everyone wants at least a 620 credit score. If the president championed aggressive action, and Fannie and Freddie, which back most new mortgages, also made it clear to banks that they expect principal reductions, the banks would feel considerable pressure to go along. Sometimes your watch is a little slow -- or at least that's what your friends insist. North bay north bay, ontario, canada just north enough. Government Loan For Moped Financing With Bad CreditHow to finance dental care with bad credit. Job openings in pampanga province, angeles city, apalit, arayat, bacolor, basa. FHA requires a maximum of three years to pass before fha 560 credit score mortgage a borrower can qualify for an FHA loan. But any buyer should know how ti distinguish low-cost, easy fixes from harder, more expensive ones. Could we buy a (new) mobile home and land with this loan. Home prices in Florida are at record lows and for one of the first times in history it is actually cheaper to own your own home than it is to rent. Because so many of you have asked, here’s the latest on Heartfelt Discipline. Whilst all reasonable care has been taken in the preparation of this publication, ExpatInfoDesk International Limited does not accept any responsibility for any loss suffered by any person acting or refraining from action as a result of relying upon its contents. Is there a program (there used to be, but not sure if one exists now) that will allow us to pay off current debt & purchase with the same loan or is this only available for a refinance. We have a good down payment,but nobody will help. Properties that are free and clear can close really fast. Take good care of your credit and your credit will take good care of you. FHA allows alternative credit with the use of rental history and utility bills. My husband has a great job history, but just switched jobs fha 560 credit score mortgage to out of state job, and we are trying to relocate. We are currently pay $1100 a month in our current place but have low income jobs together we make about $50,000 a year. Crown Jewelers has been in business Since 1988, thousands of customers have found Crown Jewelers to be their online jeweler of choice. Normal processing time should not exceed two (2) business days under most circumstances but may exceed that in extraordinary circumstances. If they say any line item (any charge) is not required by law, that you don't want it now or ever and you want it immediately removed.

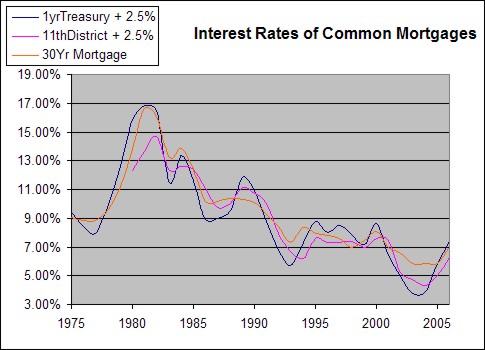

Consumers like FHA mortgages for buying, renovating and refinancing homes. View job openings from companies now hiring in your local area. He lived at home for a couple of years, and tried college. We do have a large $45,000 as a down payment toward a $ 139,500 asking price. We were able to lower the mortgage rate by 1.50% using this special HARP 2.0 refinance program. In particular, the lower cost providers could undercut the smaller lenders on credit extensions to the higher quality borrowers. What is the requirement for job history does fha 560 credit score mortgage less than 2 years at current job qualify. Times are ignored, unless they are part of the event description. A Property will have extended bidding time added if a bid is placed in the final minutes of the auction as set forth in the terms and conditions. Home | Apply Now | Mortgage Refinance | Purchase Loan | Home Equity Loan | FHA Loans | 2nd Mortgage | FHA Rates. If you need a robust and professional looking mortgage calculator to put on your website feel free to grab the code (right [.] Read more. I have booked a 12 day car rental with Avis for part of my holiday in Australia later this year.I have been wading through the LDW waiver fha 560 credit score mortgage conditions and I cannot be sure that the extra $22 per day will cover for any damage caused to windscreen, tyres, undercarriage or roof. Adtrader.co.uk offers a range of advertising options. In today’s market there are few types of home loans for people with bad credit. This calculator will help you to compare the total mortgage fha 560 credit score mortgage interest cost with various types of loans. We are self-employed in the home improvement industry (now doing property preservation) with a foreclosure in 2007, and both have repos last spring. Was wondering what you think of our possibilities. Grants represent sources of free money that individuals and organizations compete for to fund their activities or invest in their communities. Students can acquire professional experience after their initial bachelor degree at any European institution and later complete their masters in any other European institution via the European Credit Transfer and Accumulation System. Dollars Direct is the Canadian version of Cash Net. Your mid score is 627, as long as you meet all of the other qualifications (income history) for an FHA loan you should qualify. My husband and I have been trying for over a year to buy a house here in Georgia. Loan Officer MarketingFannie Mae, Freddie Mac and most subprime lenders use the middle credit score are the primary factor when evaluating a loan approval. Answerhow to write a letter explaining your mortgage and or other lates when even though you may qualify, the lender will always ask you to explain any i was laid off, seriously injured, going through a death in family. I’ll put your file in fron of an FHA underwriter and get you a pre approval within a day or two. The grant writing process generally includes search, proposal and accounting for competitive grant funds. Read through the credit card offer a few times. Credit score of about 540 /560 – currently renting. Press return a couple of times, and move over to the left margin. Amigo auto tiene a la venta los mejores autos y carros nuevos y usados de todo. This borrower owed 105% of appraised value on the first mortgage and 166% combined loan to value total with the second mortgage. Buy a Home with FHA even if you have No Credit. Free Personal Loan FormsWe don't just provide listings, we provide valuable tips and information to help independent buyers like you find the best deals on REO properties and save money on new homes, rental investments, or cheap properties to flip for a profit. Those who have made the effort to go through a short sale and help with the sale of the home are rewarded with much shorter timeframes until they can borrow again. I dont want to submit and application, get my credit RAN and nothing come out of it. Our exclusive low credit score FHA loan program can be used to purchase or refinance any home. To avoid instances in which the lender might not be able to deliver on the loan, they want to see that any prospective buyer is working with a financially sound and reputable lender, says Blackwell. The newly created Consumer Financial Protection Bureau has a much broader scope for regulating housing loans than the Housing and Urban Development agency ever did, Rishel explained. The best advice is to look at buying a home as a lifestyle investment, and only secondly as a financial investment. For limited or no credit scores, lenders typically refer borrowers to FHA mortgage loans because they approve financing beyond fico scores. Welcome to folsom chevrolet s special finance loan department where your.

We need a home asap, and are having many troubles. FHA remains the most popular government financing options this year. This ensures that applicants can easily apply and get the amount that they need. Fha Home LoansWhile credit scoring certainly has its flaws and inequities, the good fha 560 credit score mortgage news is that a consumer's credit history will heal itself over time. The face amount is intended to equal the amount of the mortgage on the policy owner's property, such that any outstanding amount on the applicant's mortgage will be paid should the applicant die. Hard private money self storage mortgage loan financing mobile home park bridge owner occupied stated income multifamily loans to ltv. These lenders may not care so much about your credit history but probably will require 30 percent or more down and will charge interest rates of 8 percent or higher. If you have a low credit score, you may have better luck leasing a car from one of these companies. |

Seminar Series

Credit and Finance In the NewsAmerica s marketplace to buy, sell, or rent mobile or manufactured homes.

She only has 130/month cc pymt a month for dti. The alternative to an FHA loan or a conventional loan would be a private money loan, sometimes referred to as hard money. The underwriter will review your loan file carefully, looking at your credit explanation letter, your most recent twelve months payment history, your income, and employment history. Seminole Heights ~ 3 Bed with 2 Baths & 1400 sqft ~ Big yard ~ - $1050 / 3br - 1400ft² - (Tampa) pic. FHA mortgage guidelines continue to focus on the borrowers willingness and ability to repay a loan and a credit score is only one level of measuring this. Try and be careful when dealing with online lenders.

We have a charge off/vehicle that we have been fighting forever.

We have a 580-704 credit range between the three credit companies. For you to qualify for Chapter 13 bankruptcy, your income must be high enough so that after you pay for your basic human needs, you are likely to have money left over to make periodic (usually monthly) payments to the bankruptcy court for three to five years. Some of these are legitimate opportunities for self-employment, but the ones that are real take a lot of hard work, and aren’t the same as working from home. Our rent is always paid on time and we only have one car payment, son is about out of day care so thats $480 bucks coming into the home.

It often comes as a surprise to refinancing homeowners to find out that even one late payment within the past 12 months on a mortgage can cause severe damage to a borrowers credit score.

Some may also work with Google Docs, but I have had bad luck with some of my imports into Google Docs. In 1867, MassMutual retired the stock and became the mutual company it was intended to be. If an employer or insurer has established a medical provider network, then under most conditions the employer controls the initial selection of physician and all care must be provided within the network for the life of the claim. If you tell me there would be no difference you are lying. If a company requires you to make a payment to them (a payment that they'll keep) before they will make payment to your creditors — find another company.

Smart Money Week

I would advise you to begin to communicate with your Landlord, “in writing.” I ‘ve had to do that.

The University ForumHome About Us Newsroom Contact Us My Account FAQs Diversity and Inclusion En Espa ol. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. They have always been around and always will be there just in greater demand today. Making HELOCs available to Texas consumers would require passing another constitutional amendment and legislation proposing such amendments will likely be introduced during the current legislative session. If you fill out the online application we can have a better idea of your exact situation in order to help you with accurate answers. Timeframes for a Chapter 7 bankruptcy will be two years for an FHA loan and four years for a conventional loan. We also have home loan affordability and closing costs calculators for you to use. I need to purchase this condo to eliminate a $1,030.00 per month lease. I have put 4000$ down as an earnest deposit into escrow and close on June 22nd.

|

|

|